The Church of England now has digital giving as the preferred means for people to support its activities. This has advantages on both sides. It means that if you go to church you don't have to worry about finding it's a choice between 13p in small change or a £20 note that is more than you can really afford when the collection plate comes round. It means your treasurer doesn't have to spend ages counting up, recording and banking lots of cash and then submitting Gift Aid claims on it. The banks are now also increasingly charging 'business' customers (which includes churches) for paying in cash and processing cheques.

The Church of England now has digital giving as the preferred means for people to support its activities. This has advantages on both sides. It means that if you go to church you don't have to worry about finding it's a choice between 13p in small change or a £20 note that is more than you can really afford when the collection plate comes round. It means your treasurer doesn't have to spend ages counting up, recording and banking lots of cash and then submitting Gift Aid claims on it. The banks are now also increasingly charging 'business' customers (which includes churches) for paying in cash and processing cheques.

For those who want to make a regular gift to their church the Parish Giving Scheme (PGS) is now used by churches in the majority of dioceces. Leeds Diocese introduced PGS in January 2020 and the 3 parshes of the Stanwick Group of Churches registered for it in March - unfortunately just before the country went into lockdown so we were unable to launch it properly to our parishioners.The cost of operating the PGS service is borne by the Diocese, not the parish. Those dioceses that have used this scheme for years say that the increased income to parishes is worth the cost to them.

This briefly is how it works - but do check the PGS website as well for additional clarification.

This briefly is how it works - but do check the PGS website as well for additional clarification.

- The parish needs to register with PGS so that it can receive donations via the scheme. We have done this. Our details are given below.

- The donor needs to enrol in the scheme and the easiest way to do this is via their website (which can now locate your church for you) but you can also do it either by using the PGS form from church or your Treasurer, or by telephone (see below) with the option to make regular donations monthly (preferred) quarerly or annually.

- The donor also needs to indicate if they agree to an annual inflationary increase to their donation. (See more on this below)

- If you wish you may also opt to give to your church anonymously (See more on this below)

- Your gift will be taken by Direct Debit, which comes with the official DD guarantee, and will leave your bank on 1st of the month.

- On receipt, PGS will then put in a request to HMRC for a repayment of Gift Aid (assuming you are a UK tax payer and have completed the GA declaration when enrolling)

- PGS then pays your gift to your church's account by 10th of the month, with GA following once it has been received from HMRC (within days, sometimes even on the same day as the main donation)

- When you attend church there is no need for a 'conscience donation'; you just pick up a PGS token as you enter and put that in the collection plate.

- You experience not only a sense of satisfaction but also a happier, less stressed Treasurer who has more predictable income for the church and a lot less administraton to deal with in looking after it.

Here is a short video that explains it simply.

If you would like to enrol with PGS, the easiest way to do so is to enrol via their website but they also have a dedicated telephone line, 0333 002 1271, open Monday to Friday, between 9 – 5pm. Otherwise you can get a paper enrolment form by contacting your Treasurer.

Before you contact PGS you will need your bank account details, church/parish name and PGS parish code to hand.

The parish names and codes in our benefice are:

Melsonby - St James the Great - 460646415

Forcett - St Cuthbert - 460646240

Aldbrough St John - St Paul - 460646017

if you currently give by Standing Order, then you will need to cancel this with your bank, PGS cannot do that for you.

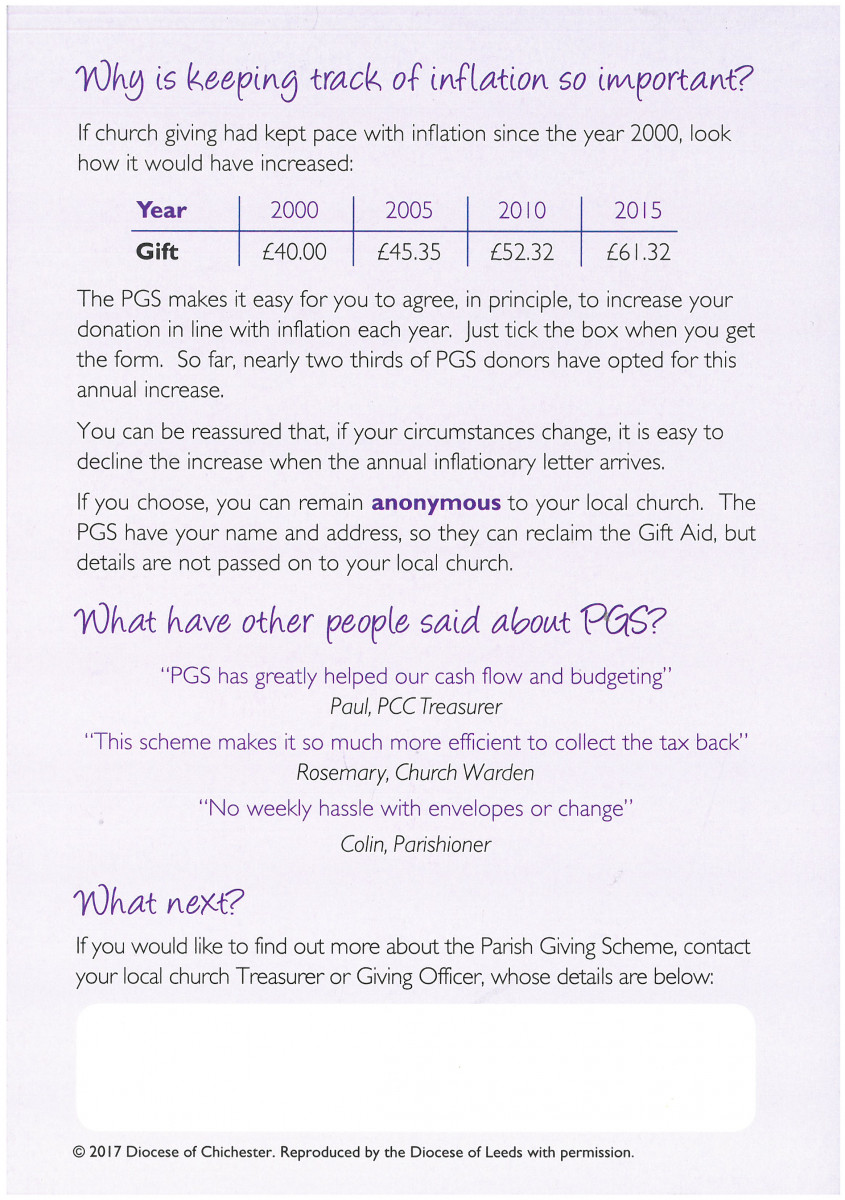

Inflationary increases

A major problem with Standing Orders is that while they guarantee a regular income, they are frequently left unchanged for many years as Treasurers are embarrassed to mention it and donors simply forget about it, so their real value diminishes. (Click on the graphic, right, to see how this affects donation value) This is known as 'donation stagnation' and costs parishes a considerable amount of income each year. PGS offers the opportunity to agree to an annual increase in line with the Retail Price Index so your donation keeps pace with inflation. However, you are contacted one month before the increase is due to give consent to the increase. At this point you can simply agree or, as many donors do, ask to round it to a more memorable sum. But it may be that circumstances have changed during the year and you wish to reduce or even terminate your donation. That too is quite acceptable (though, naturally, regretted)

You can also go online to PGS and change or cancel your donation at any time yourself.

Giving anonymously

If you want to give to your church anonymously for whatever reason, you can let PGS know this when you enrol as they are not part of your church but are an online charitable donations collection organisation (like sites such as JustGiving) based in Gloucester. You will, of course, need to give PGS your details so that they can collect Gift Aid but they will not be passed on to your recipient church.

Having said that, PGS would prefer that you do allow your church to know that you give to them. Not only does it mean they can thank you, it also means they won't be continually asking you to sign up to PGS!

PGS Website

Do have a look around the Parish Giving Scheme website. We would encourage you to convert to this method of giving to our parishes if you can. If you want to give to more than one church that is perfectly acceptable. Whatever you do, thank you for your support.